The Darden School of Business at the University of Virginia in Charlottesville

The Darden School of Business at the University of Virginia in Charlottesville

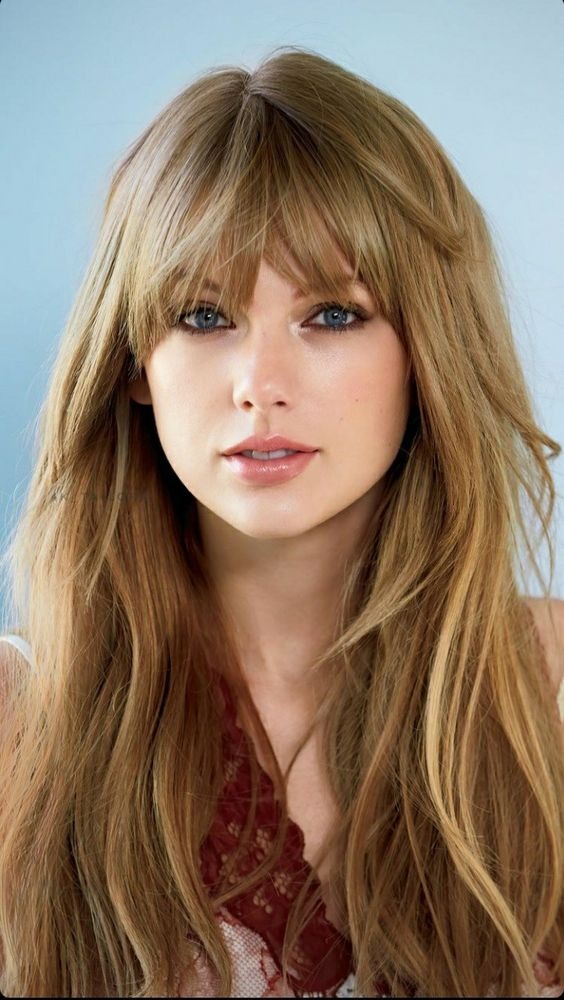

Taylor Swift is everywhere – even in the MBA curriculum.

The University of Virginia’s Darden School of Business announced a new case, titled “Shamrock Capital: Pricing the Masters of Taylor Swift.” It offers an in-depth look at both the human and business factors that Shamrock Capital—an investment fund that paid $300 million for Swift’s old music—had to consider when evaluating the purchase of Taylor Swift’s masters in 2020.

“This is my worst-case scenario,” she told Variety. “This is what happens when you sign a deal at fifteen to someone for whom the term ‘loyalty’ is clearly just a contractual concept.”

A STUDY OF MASTER RECORDING VALUATION

The new case, which will be taught at Darden in the core finance curriculum, is essentially an intro to firm valuation using discounted-cash-flow (DCF), market multiples, and the perpetuity model for terminal value estimation.

The new case, which will be taught at Darden in the core finance curriculum, is essentially an intro to firm valuation using discounted-cash-flow (DCF), market multiples, and the perpetuity model for terminal value estimation.

The case is designed with four key learning objectives:

The case is designed with four key learning objectives:

1) Introduce firm valuation techniques based on a simple DCF model or market multiples.

2) Stimulate an appreciation and understanding of the perpetuity model for estimating terminal value.

3) Estimate the cost of capital using industry comparables.

4) Build intuition about the relationship between firm growth, operating profitability, and value creation.